Satisfaction:

Potential Return:

Associated Risk: Low.

Investment Horizon: Free.

Summary

Highlights of AuCOFFRE

- Simplified access to physical gold starting at 0.5 g. Ideal for accessible diversification.

- 100% online platform, with a marketplace available 24/7.

- Secure storage in Switzerland (Free Ports of Geneva), one of the safest places in the world.

- Custody fees waived if you invest monthly.

- Proven reliability: 15 years in existence, ISO 9001 certification, independent audits, and reports available online. Over 40,000 users and 700 million euros in assets under management.

Weaknesses of AuCOFFRE

- Before you can make your first purchase, you should allow 3 to 4 business days for your profile to be fully validated (validation of supporting documents and the deposit via SEPA direct debit).

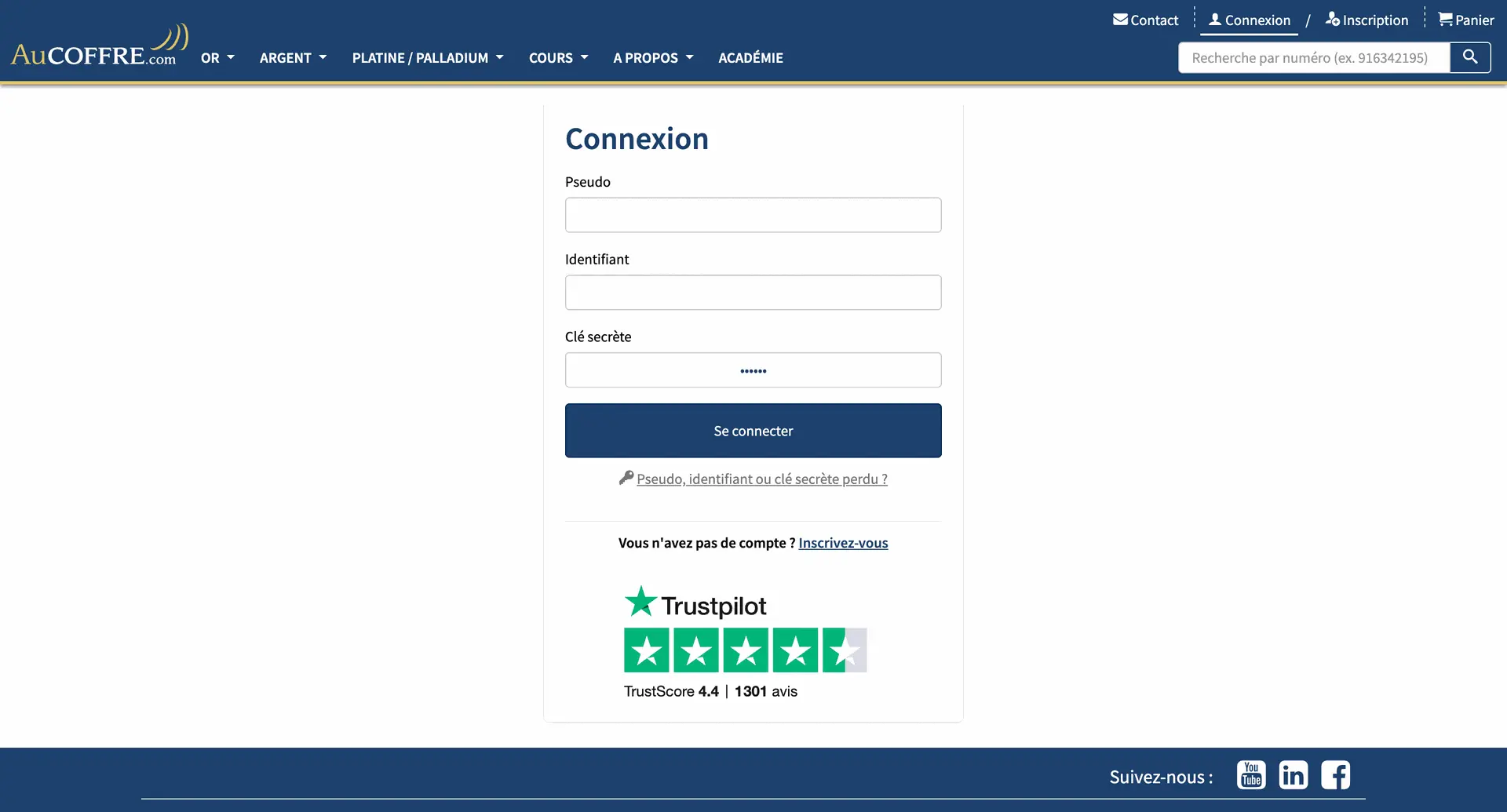

- Sign in to the platform relies on an unconventional triptych: a public username and a private identifier assigned by the platform, and a 6-digit secret key to be defined. You must memorize these three elements in order to log in. We would have preferred a more modern solution, such as two-factor authentication (2FA) or a mandatory phone call for sensitive changes (e.g., changing the withdrawal bank account details).

Context

At the intersection of traditional assets (stocks, real estate) and tangible investments, there is a category that ticks both boxes.

Discreet in financial news but deeply rooted in our economic history, gold is a staple of wealth management. From antiquity to the vaults of central banks, its legitimacy as a store of value has never been questioned, given the strength of its fundamentals. It can be found everywhere, in the form of raw material, bars, coins and tokens, jewelry, or even as a financial asset. Its longevity, stability, and the diversity of its uses may make it the ultimate investment.

At the end of May 2025, I received a message on LinkedIn from Jean-François Faure, founder of AuCOFFRE, VeraCash, VeraOne, CrypCool, Foret.com, as well as the blog L’Or et L’Argent. This was an opportunity to introduce him to Off Market Journal and to propose testing the services of his platform AuCOFFRE in order to write a feedback report. Although I was already convinced of the value of holding a portion of gold in my assets, I seized this opportunity to test one of the main French platforms in the sector and to form my own opinion.

AuCOFFRE, what is it?

Founded in 2009 by Jean-François Faure, AuCOFFRE.com is one of the French pioneers of online investment in precious metals. The platform allows users to buy and sell gold, silver, platinum, and palladium, 24/7, to other individuals or directly offered by AuCOFFRE at the exact price of gold.

The 40,000 users can acquire investment coins (Napoleons, Swiss Franc, Krugerrand, Sovereign, Liberty, new US Dollars, Mexican Pesos, Canadian Dollars, Australian nugget, Vienna Philharmonic, Panda, Britannia, etc.), as well as bars, small bars, or tokens.

A particularly interesting point: AuCOFFRE also offers fractional purchasing. It is therefore possible to acquire a share of a coin or a bar stored in a vault, making the investment even more accessible. The storage is provided in highly secure vaults located in France or Switzerland. It is also possible to choose home delivery if one wishes to keep their assets themselves.

With over 700 million euros in assets under management, AuCOFFRE has established itself as a key player in the French and Swiss investment gold market, particularly for those seeking a tangible exposure that is uncorrelated with financial markets and independent of the banking system.

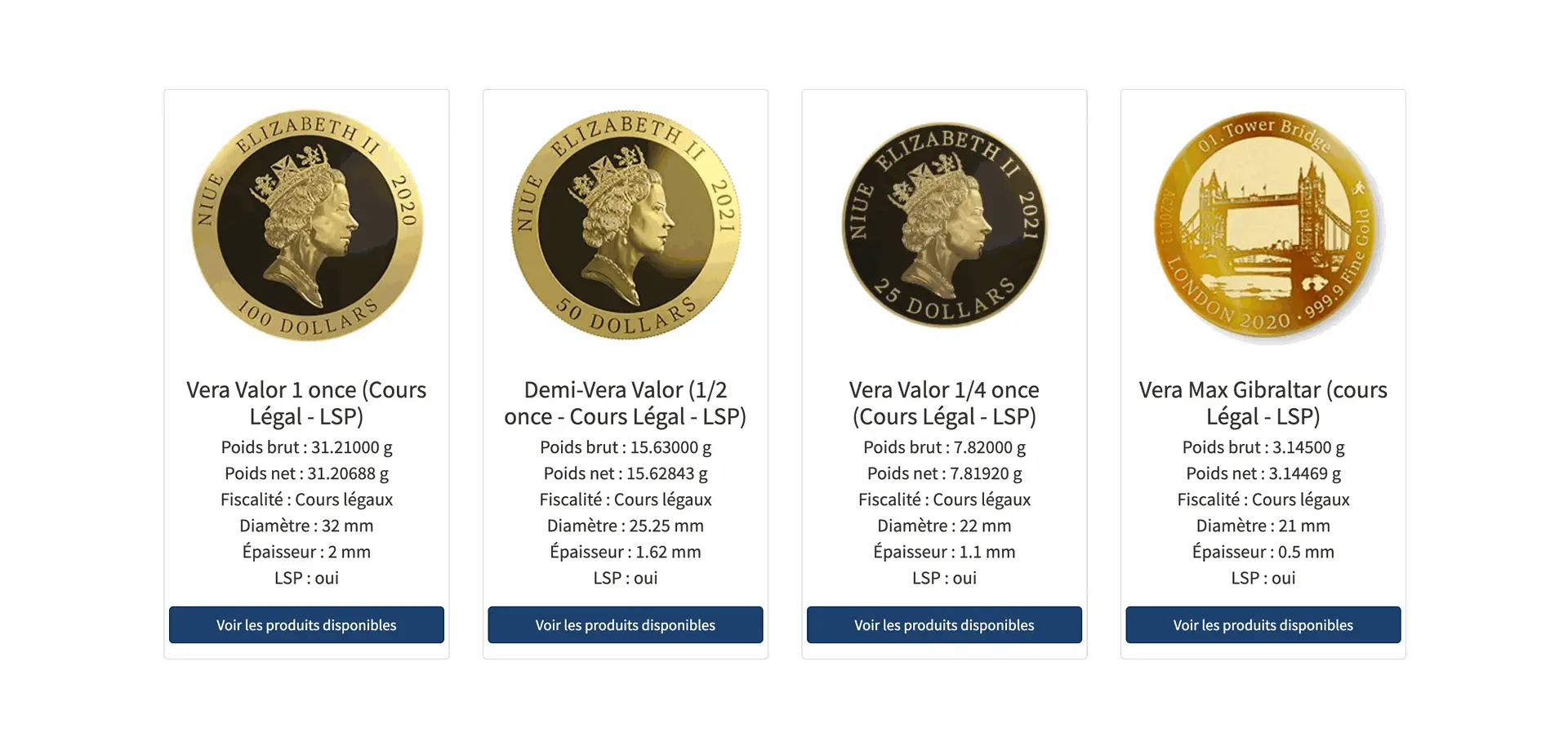

Vera Valor

Beyond its role as an intermediary in the precious metals market, AuCOFFRE.com has also developed its own range of coins and tokens: Vera Valor. This signature sub-brand includes exclusive creations in gold and silver as well as raw gold nuggets.

Launched in 2011 with the very first Vera Valor 1 ounce coin, the brand stands out for its exceptional level of purity: 999.9 thousandths for gold and 999.0 thousandths for silver. These coins and tokens are made from metals certified by the London Bullion Market Association (LBMA). This is synonymous with quality and responsible sourcing. The extraction conditions are rigorously monitored by independent auditors, ensuring a responsible origin.

In 2015, AuCOFFRE reached a symbolic milestone by becoming the first French company to mint a legal tender investment silver coin, in partnership with the government of Tanzania: the Vera Silver Zanzibar.

The manufacturing process of Vera Valor coins reflects the brand's standards. The gold comes from LBMA-certified refiners such as Sempsa (Spain) and Metalor (Switzerland), who supply the "blanks" (virgin metal discs intended for striking). These blanks are then sent to Faude & Huguenin, a prestigious Swiss assayer and foundry, which handles their final transformation.

Vera Valor has already produced over one million pieces in gold and silver, which places the minting activity of the AuCOFFRE.com group in second place nationally in the field of token and investment coin manufacturing, after the Paris Mint.

How does AuCOFFRE work?

The operation of AuCOFFRE.com is based on a hybrid marketplace model where AuCOFFRE products compete with those already owned by individuals who wish to sell.

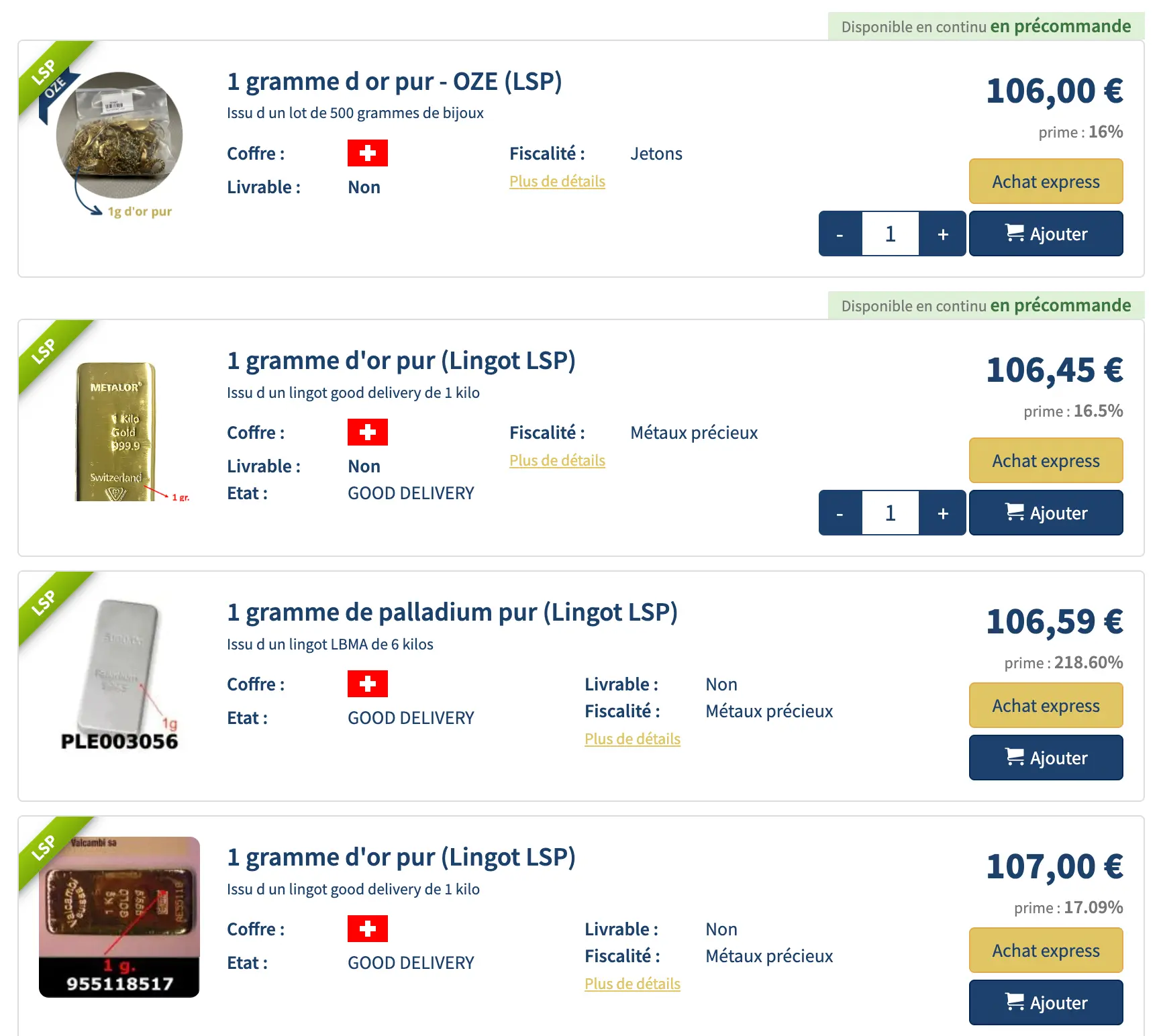

The minimum purchase is 0.5 grams for gold and 1 ounce (31.12 g) for silver. All products sold on the platform come from the professional market and are systematically verified by numismatic experts.

Offers from individuals

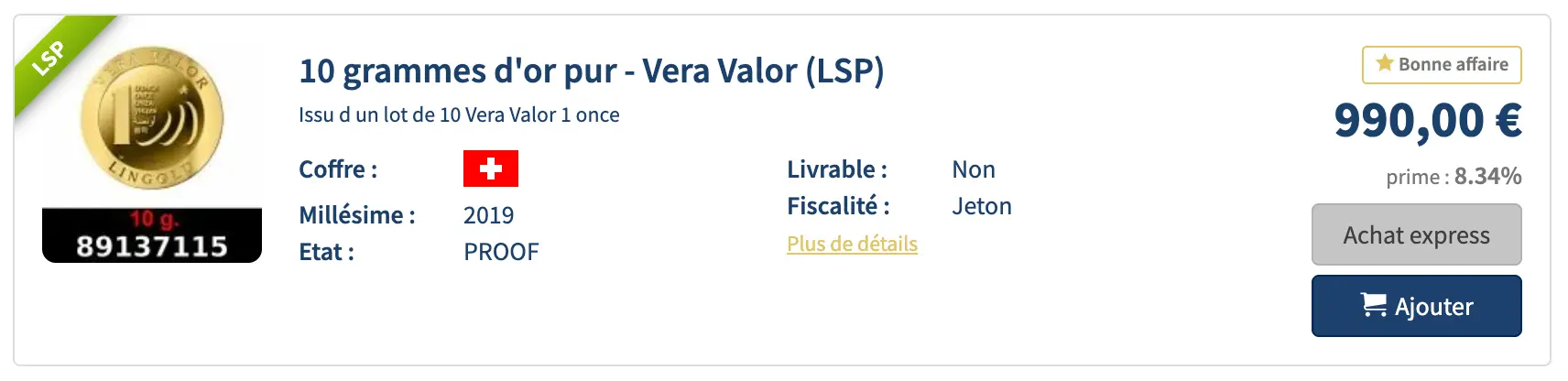

This is undoubtedly the most distinguishing element of AuCOFFRE. In the manner of a true exchange, members can freely set their selling prices, thus creating a form of quotation between individuals. Unlike traditional gold merchants who impose a buying and selling price, this system provides more flexibility to users. All of this comes with an optimal level of security, as the coins do not physically change hands. If the offer is below the gold price, it is marked with a "Good Deal" label.

Direct sales AuCOFFRE

Some coins or bars are offered directly by the platform and are identifiable by a "pre-order" banner. Here, the price is indexed to the market value of precious metals and serves as a market reference. Users can thus position themselves to buy or sell around this regulatory price.

Personalized service

Designed for investors with at least €5,000 to spend, this service offers tailored support: introductory meetings, wealth assessments, selection of rare coins not in the catalog. I haven't had the opportunity to test this service.

Even though the exchanges occur between members, the reality is more subtle: the majority of coins and bars have never left the secure vaults of the Free Ports and Warehouses of Geneva. Therefore, it is only digitized property titles that change hands. The result: no risk of fraud or degradation, as the products remain sealed, under control, and in a controlled environment.

How does AuCOFFRE secure gold?

AuCOFFRE.com offers its members two distinct options for the storage of their precious metals: storage in Switzerland or storage in France with the possibility of home delivery.

Storage in Switzerland – Free Ports and Warehouses of Geneva (PFEG)

This is the option chosen by 97% of users. Coins and bars are stored in the ultra-secure vaults of the Free Ports and Warehouses of Geneva, a site recognized worldwide for its level of security and the billions of euros worth of artworks and highly valuable objects it contains. AuCOFFRE holds several vault rooms there, where more than 5.5 tons of gold and 50.2 tons of silver are currently kept for its clients.

In addition to physical security, this solution also benefits from a stable legal framework due to Switzerland's political and economic neutrality, protecting assets from any risk of bank failure or seizure by states. The safes are pooled and insured up to the value of their contents.

Another advantage of this solution is immediate liquidity: members can buy or sell their coins at any time directly from their personal space. The metals do not move; only the digital ownership title is transferred from one member to another. This ensures optimal preservation of the products, in their original seal, without risk of alteration or fraud.

Care in France – Home Delivery

For those who prefer to have their metals physically in hand, AuCOFFRE also offers storage in France and the option to request home delivery. This option allows investors to directly hold their coins. A choice that can reassure those who prioritize tangible ownership or wish to access their gold without any third-party trust.

The steps to invest on AuCOFFRE

At the creation of your account, you fill in your information and set a 6-digit secret key, and you are assigned a username and an ID in return. This information should be kept safe, as these 3 elements will allow you to log in to your account..

Then, to save time, I recommend that you start by taking the time to complete your profile to 100%, including submitting your supporting documents for validation, and if you know how much to invest, to deposit your budget into your waiting account. This will save you from waiting and paying credit card fees when you are ready and know what to invest in.

I also strongly recommend that you schedule an appointment with your account manager by phone or via video conference. This is what I personally did with Anthony Busco, and it allowed me to understand some very important things that are explained in this article and to avoid potential mistakes.

LSP (The Premium Service)

AuCOFFRE offers a particularly advantageous system called LSP (The Premium Service), designed for those who wish to invest regularly while benefiting from free storage in a vault.

The principle is simple: by purchasing a minimum amount of LSP-labeled precious metals (gold, silver, platinum, or palladium) each month, you validate your right to free storage for all your existing LSP products. This minimum amount is calculated based on your existing stock, in order to encourage a DCA (dollar-cost averaging) investment strategy.

The products in question are easily identifiable thanks to a specific marking. However, please note: only products marked LSP benefit from this exemption from storage fees. If you have a mix of LSP and non-LSP products, the fees will only apply to the non-LSP portion.

Fundamental analysis of AuCOFFRE?

Profile of the leader: Jean-François Faure

I really discovered Jean-François Faure during an interview given in February 2024 at the microphone of Mounir Laggoune (Finary). That day, I met an atypical profile, halfway between a serial entrepreneur and a self-taught expert in precious metals. A curious, clear-sighted man, resolutely focused on concrete solutions.

Nothing predestined him to become one of the French pioneers of alternative investment. Son of farmers and trained as an architect, he began his career as a project assistant at Lacrouts & Massicault in 1994. Then, drawn early on by the opportunities of the emerging web, he ventured into creating websites and search engine optimization. In 1995, he co-founded Référenceur.com, one of the first French services in this field. He successfully sold this company in 2000, just before the burst of the internet bubble, and then followed up with the creation of a translation agency, at a time when automated solutions did not yet exist.

But it was the financial crisis of 2008 that marked a turning point. Concerned about protecting and diversifying his personal savings, Jean-François Faure became interested in precious metals. He then realized the complexity of accessing gold in France: banks no longer offer it, shops do not meet the needs of businesses, and platforms like eBay do not guarantee quality or security. He first created the blog L’Or et l’Argent to document his discoveries, and then ventured into entrepreneurship with AuCOFFRE.com, launched on April 16, 2009.

One year later, on April 16, 2009, he ventured into entrepreneurship with AuCOFFRE.com.

The concept is innovative: allowing the purchase, sale, and secure storage of physical gold through an online platform, outside the banking system. The success is immediate: one first customer on the launch day, 150 by the end of the year, 900 in 2010, with revenue increasing from 4 million to nearly 8 million euros in two years.

But Jean-François Faure does not stop there. He innovates with VeraCash (2015), a payment card backed by precious metals. Then in 2019, he creates VeraOne, a 100% ERC20 token backed by physical gold, and finally CrypCool in 2022, a secure solution for the storage of digital assets (cold storage), registered as PSAN with the AMF.

Note: Jean-François Faure is primarily an entrepreneur. He has clearly demonstrated his ability to manage and grow a business over the long term. Although he has likely developed a passion for precious metals over the years, he maintains a clear-eyed and sufficiently detached perspective to consider alternatives to his own solution. Rather than dismissing Bitcoin, which attracts the same types of savers seeking a store of value, he chooses to integrate it into his ecosystem by launching CrypCool and VeraOne.io

Is AuCOFFRE reliable?

Regarding reliability, AuCOFFRE.com offers solid guarantees. On the customer review side: 1,301 reviews on Trustpilot with an average rating of 4.4/5, the platform enjoys a serious reputation built over more than 15 years of activity.

Since 2022, AuCOFFRE has been certified ISO 9001:2015, an international standard for quality management. This certification attests to the rigor of the processes implemented within the company: customer orientation, leadership, employee involvement, continuous improvement, evidence-based decisions... all criteria that are regularly audited and that enhance the credibility of the entire system.

In terms of transparency, clients even have the option, if they wish, to physically visit the Free Ports and Warehouses of Geneva to verify the presence of their metals. This visit is charged at €250, with a 2% commission applied in the event of an actual withdrawal.

The vaults are also audited each year by a combination of four independent entities:

- CAC (Statutory Auditor), as required by French regulations.

- Customs, able to intervene at any time without notice.

- ALS Inspection (formerly Stewart Group), which verifies the integrity of the stocks and their correspondence with the property titles of the members.

- The Association of AuCOFFRE User Members (AMUAC), an independent body that participates in the audit and represents the interests of users.

Note: Audit reports, insurance certificates, and inspection documents are available for public consultation on the AuCOFFRE website.

Alternatives to AuCOFFRE

Having not yet had the opportunity to test the solutions offered by direct competitors to AuCOFFRE, I will stick to other methods of holding.

Gold guard at home

It is undoubtedly the most intuitive option and the one favored by our ancestors to keep their precious metals. No storage fees, no logistics, your gold is hidden and under your own responsibility.

The main danger is obviously theft or loss because if you choose this option, you will eventually have to disclose the location of your stash, if only to ensure the succession of your treasure in case something happens to you.

Contrary to what many people think, standard home insurance policies do not cover this type of asset. To obtain appropriate coverage, you need to purchase a specific extension, which results in a significant increase in your annual premium. And even in this case, full reimbursement is rarely guaranteed.

Gold storage in bank vaults

At first glance, a bank safe seems like a reassuring option. However, when it comes to precious metals, this solution has several limitations.

First, in the event of a major banking or financial crisis, a bank may be forced to close its doors without notice, temporarily making access to your safe impossible. However, it is precisely during these moments of tension that gold becomes strategic.

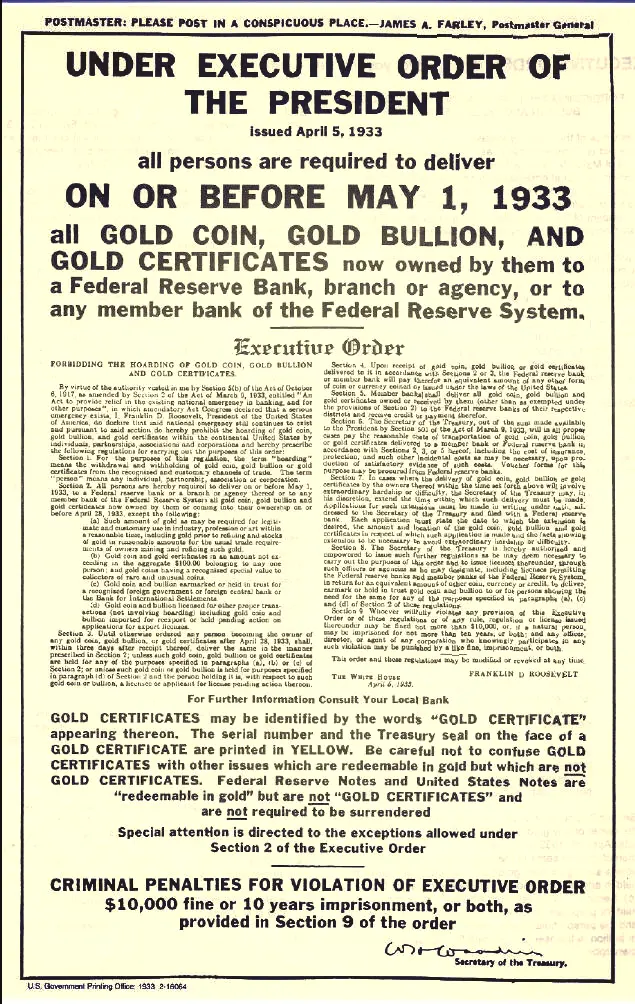

Next, there is a more subtle regulatory risk: in France, the State retains the right to requisition or restrict access to precious metals held by individuals. This type of measure has been applied in history, such as in the 1930s.

What returns to expect on AuCOFFRE?

My operations

Since July 2025, I have chosen to invest at least 0.5 grams of gold each month through AuCOFFRE.com. This gold is a fraction of a 500-gram lot of gold jewelry and meets all the strategic criteria I have set for myself.

- 1. The smallest investable amount

The half-gram is currently priced at €60, including a 30% premium, which already represents more than 10% of a monthly investment budget of €500. If the price of gold continues to rise, this unit may become the only accessible entry ticket for average investors. Thus, I avoid ending up with illiquid assets in the future.

- 2. Maximum flexibility for resale

Rather than locking a large sum into a single piece of €1,000, this fractional format will allow me to liquidate my assets gradually, according to my needs. This way, I can trade more freely, selling only a few 0.5 g packets instead of a block, if necessary.

- 3. Conservation in Switzerland

Like a Luxembourg life insurance policy, holding my assets outside of French territory (in the Free Ports of Geneva) provides me with enhanced guarantees.

- 4. No childcare fees

Thanks to the LSP (Premium Service) eligibility of this product, I do not pay holding fees on my gold jewelry. This is an important advantage in a long-term investment strategy.

- 5. A cautious approach after a strong increase

With a performance of +27.22% in 2024, gold has experienced a remarkable rise, fueled by global geopolitical tensions. I anticipate a potential correction that would allow me to increase my exposure to the yellow metal.

- 6. Tax optimization

By investing in tokens (and not coins), I benefit from a favorable tax regime: as long as my sales do not exceed €5,000, they are tax-exempt. It's a comfortable margin that gives me flexibility.

My performances

Unlike other platforms that I usually test on Off Market, the performance here is not delegated. It does not depend on the opportunities identified by the platform or its expert partners. It solely depends on our own buying and selling decisions, and the evolution of gold prices in the markets.

I am fully aware that I am entering a market that has been regularly setting new records since September 2019 and has literally been soaring since December 2023. A correction is possible, even probable, if geopolitical tensions ease, but I cannot predict the future. Gold is influenced by a myriad of factors such as interest rates, inflation, confidence in fiat currencies, and trying to "time" the market is very complicated.

That’s why I chose to apply a DCA strategy (dollar-cost averaging), in order to smooth my entry point. If a correction occurs, I will take the opportunity to strengthen my position at a better price.

I will update this section as soon as a partial or total resale is made on AuCOFFRE, in order to accurately measure the net gains or losses recorded.

Risks

The risks associated with investing in precious metals

Although gold and precious metals are likely the most resilient assets in financial history, weathering crises, monetary collapses, and geopolitical upheavals, no investment is without risk. Here are some of the main risks to consider:

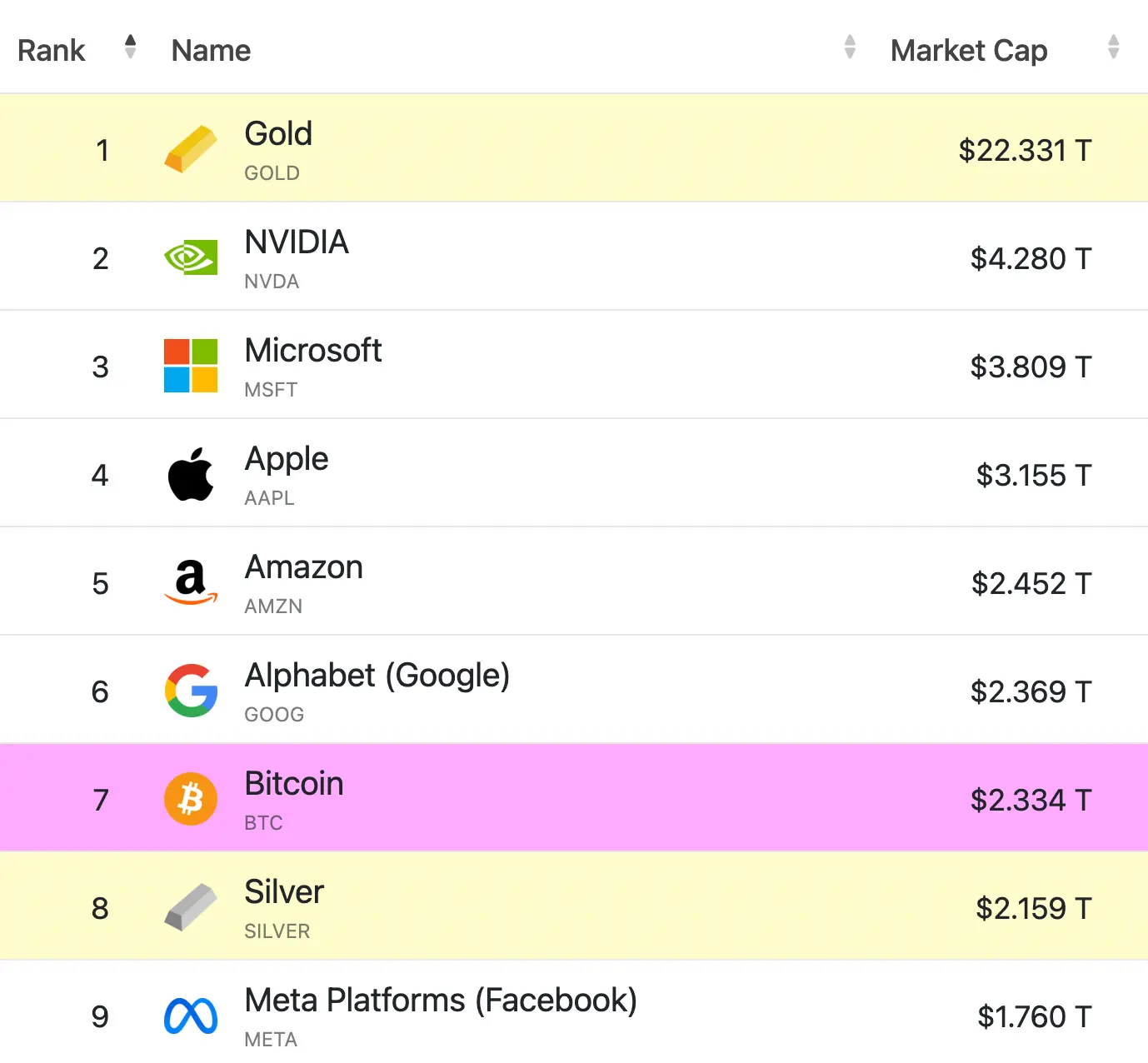

- Growing Competition from Bitcoin

The emergence of Bitcoin as a store of value is attracting a new generation of investors. This competition could, in the long run, challenge gold or at least offer an alternative to protect one's wealth that did not previously exist, thus sharing the pie.

- Lack of liquidity for certain formats

Not all forms of metal are equal when it comes to resale. Less desirable ingots and coins may take longer to sell, or require a discount to find a buyer quickly. - Regulatory and tax developments

Taxation applicable to precious metals may change to our disadvantage, depending on fiscal policies, the economic environment, or government priorities. This may impact the net profitability of investments.

This list of risks is obviously not exhaustive, but it suggests possibilities that are not the first ones we think of.

The risks associated with AuCOFFRE

Although our analysis has demonstrated the strength of this player, zero risk does not exist. Here are some risks to consider:

- Unregulated model by the AMF

AuCOFFRE.com is not a management company approved by the Financial Markets Authority (AMF). Although this is not required for their activity, it means that you do not benefit from the standard guarantees associated with a regulated banking or financial institution. - Platform-dependent liquidity

Even though the secondary market of AuCOFFRE is fluid, the resale of your assets depends on the proper functioning of the site, the activity of the members, and the available liquidity. In the event of a decrease in activity or a crisis of confidence, the speed of executing sales could be impacted. - Operational or technological risk

Like any digital platform, AuCOFFRE is exposed to technical risks: hacking, software bugs, temporary unavailability. Events that can slow down or even temporarily suspend access to your assets or the site's features.

These risks are managed and limited by the experience, transparency, and legal structure of the platform, but it is essential to incorporate them into your thinking, as with any investment.

Fees and taxation

Fees

AuCOFFRE.com applies a very transparent pricing structure. Here is a summary of the main costs to expect:

- Purchase fee: 0.5% of the amount invested for each transaction.

- Sales fee: 3% of the sale amount.

Regarding vault storage (excluding LSP), the fees vary depending on the type of metal:

- Pure gold: €5 including tax per month for every 100 g stored.

- Pure silver: €5 including VAT per month for every 2,000 g stored.

Finally, for those who wish to have their gold coins delivered in mainland France from a safe located in France, the billing is as follows:

- €15 including tax for the first shipment (in the case of a single item), then €50 including tax for each tranche of €2,500 sent.

Taxation

Capital gains

The capital gains generated from the resale of precious metals through AuCOFFRE are subject to specific taxation, but certain products allow for a total exemption, under certain conditions.

If the resold product falls into the tax category of tokens (e.g., jewelry) or legal tender coins, and the transaction is less than €5,000, no capital gains tax is due.

Furthermore, in the case of a loss, zero gain, or if the resale occurs after 22 years of holding, no taxation or declaration is required.

In all other cases, the seller must complete a 2091-SD declaration, to be submitted to the tax administration within the month following the transfer. However, this obligation does not apply:

- If the transaction is carried out through an intermediary that is tax-resident in France (which is the case with AuCOFFRE)

- if the buyer is a professional subject to VAT and established in France.

VAT

The applicable VAT depends on the metal in question and the format in which it is purchased.

- Investment gold (bullion, coins, legal tender) is exempt from VAT upon purchase.

- Investment money, on the other hand, is subject to a VAT of 20% upon purchase, except for certain exceptions. AuCOFFRE.com allows for circumventing this tax in specific cases:

- Legal tender silver coins are exempt from VAT, both at the time of purchase and resale (if the transaction remains < 5,000 €).

- Metal silver stored in a free zone, particularly in the Free Ports and Warehouses of Geneva, is not subject to VAT.