Return Achieved: 15%

Associated risk: Low

Horizon of investment : 9 mois

Summary

What I liked about this investment:

- The low minimum ticket to access this type of items

- A buyback guarantee after 9 months in the absence of a buyer for the lot.

- The possibility of delegating all the steps to a specialized and experienced company.

Possible areas for improvement:

- Receive more proactive communication, such as a mid-course email summarizing key events or upcoming ones. For example: “On December 10, the lot will be presented at an auction…”.

- Being invited to physically discover the watches to enhance the experience

Context

Yes, watches are increasingly seen as investment objects, but this only applies to certain highly sought-after models from prestigious brands. Although some pieces from these houses are still available for purchase, they are often reserved for a select clientele that has built a strong relationship with the brand through a significant purchasing history. Thus, being offered the opportunity to acquire one of these watches is already a privilege.

A privilege that grants access to something very rare in terms of investment. Indeed, these models being practically inaccessible when new, their value in the second-hand market is often much higher. This means that you realize a latent capital gain as soon as you acquire your watch.

Another factor explaining why the second-hand market sometimes exceeds the prices of new items lies in the waiting times to obtain these pieces. Similar to certain car brands like Ferrari, acquiring exclusive models such as the Patek Philippe Nautilus can require a wait of several years, sometimes up to a decade, as reported by some media outlets.

The Audemars Piguet Royal Oak, the Omega Speedmaster, and the Cartier Santos model are among the watches that, due to their high demand, have inadvertently generated significant speculation and amplified interest in these precious accessories. This situation frustrates true enthusiasts, who see opportunists, lured by the prospect of profit, driving up market prices and making the supply increasingly rare and inaccessible.

How to invest in luxury watches?

If you have looked at the prices of the previously mentioned models, you are surely wondering how you could find your place in such a competitive sector, where networking is often crucial and where the greatest fortunes compete for access. Even if you have the means to acquire one of these items, you would run the risk of concentrating all your investment on a single element.

Alternative investments, while attractive, are generally considered to be riskier than traditional investments, making diversification even more essential. It is precisely these issues that I am trying to find solutions for.

Presentation of Caption

To carry out my first transaction, it was essential for me to find a trustworthy intermediary, both expert and independent. The opportunity presented itself to me unexpectedly, just as I was starting out in the field of alternative investments, by taking an interest in the Private Equity.

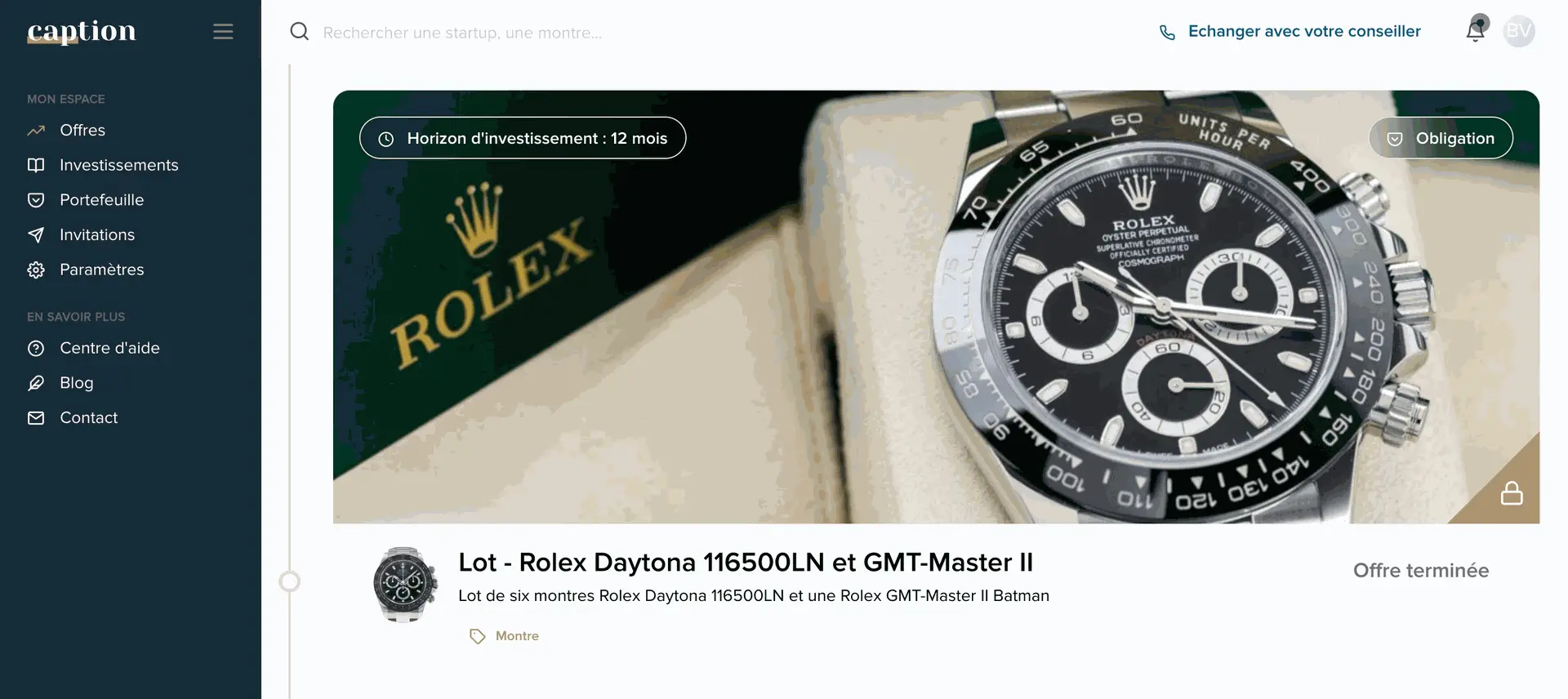

Caption Market, The platform I was using to invest in our most beautiful French start-ups began to transform its model to offer deals dedicated to exotic assets. At first, it was mainly art (Yves Klein, Yayoi Kusama, Andy Warhol, Jean Dubuffet, etc.) and watches (Rolex Daytona, Patek Philippe Aquanaut). Until that famous offer that caught my attention.

Since then, Caption has continued in this direction, gradually reducing its investment opportunities in FrenchTech start-ups to prioritize tangible asset classes. Today, the platform offers a wide range of original investments, in partnership with specialized experts. Notably, we have seen the following proposed:

- a selection of gold coins from the Middle Ages to the Renaissance, in collaboration with Numismatic, a company led by a numismatist from the Taittinger family;

- The music rights of 1,212 artist tracks, offered in partnership with Bolero ;

- financing offers for a collection of vintage vehicles managed by Mecanicus ;

- a selection of exceptional wines;

- a fleet of electric Tesla vehicles available for rent by Urban COD;

- investments in racehorses through Pur Sang Invest;

- shares of forestry groups, such as CoeurForest;

and many other equally innovative and attractive proposals.

My complete analysis of Caption

In which watches have I invested?

The offered lot consisted of 7 exceptional watches: 6 Rolex Daytona 116500LN and one Rolex GMT-Master II "Batman." Even without being an expert, this selection immediately seemed relevant to me, as these two models are rare and highly sought after. Indeed, the waiting time to hope to acquire them in-store can extend over several years, and transactions in the secondary market systematically include a premium of at least 20% compared to the retail price.

However, if this offer caught my attention much more than the similar proposals already seen on the platform, it is for two main reasons.

First, the investment horizon was particularly short: only 12 months, compared to a usual minimum of 24 months. Ideal in a watchmaking market that has been in strong correction since the beginning of 2022.

Secondly, the contract concluded between Caption and its partner Toutim Invest included a clause that, in the absence of a buyer after nine months, activated a buyback option by the expert with a 15% premium.

This clause amazed me as it seemed unrealistic. If I hadn't had great confidence in Caption, I would have found it hard to believe such a proposal. I was therefore almost certain to complete this operation in the black and with a considerable return on investment. Even in the stock market, achieving a 15% return in a year while being exposed to the American market is a very impressive performance.

Off Market Note

In hindsight, I understand that if the partner could afford to offer such a guarantee, it was because he was confident he had found a good deal. This also illustrates the impressive opportunities that these collectible markets can offer when expertise and experience are combined. These items, beyond their beauty and rarity, reveal their full potential as alternative investment assets.

Features of the Rolex Daytona 116500LN

This watch is a tribute to racetracks and is designed for speed enthusiasts. It is renowned for its precision, durability, and timeless design.

Main features:

- Material: 40 mm Oystersteel case with black Cerachrom ceramic bezel.

- Movement: Caliber 4130, automatic winding mechanical, with a power reserve of 72 hours.

- Features: Precise chronograph and tachymeter engraved on the bezel, ideal for measuring speeds.

- Bracelet: Oystersteel, sturdy and elegant.

Particularity: High demand in the secondary market, with prices often exceeding those of new items.

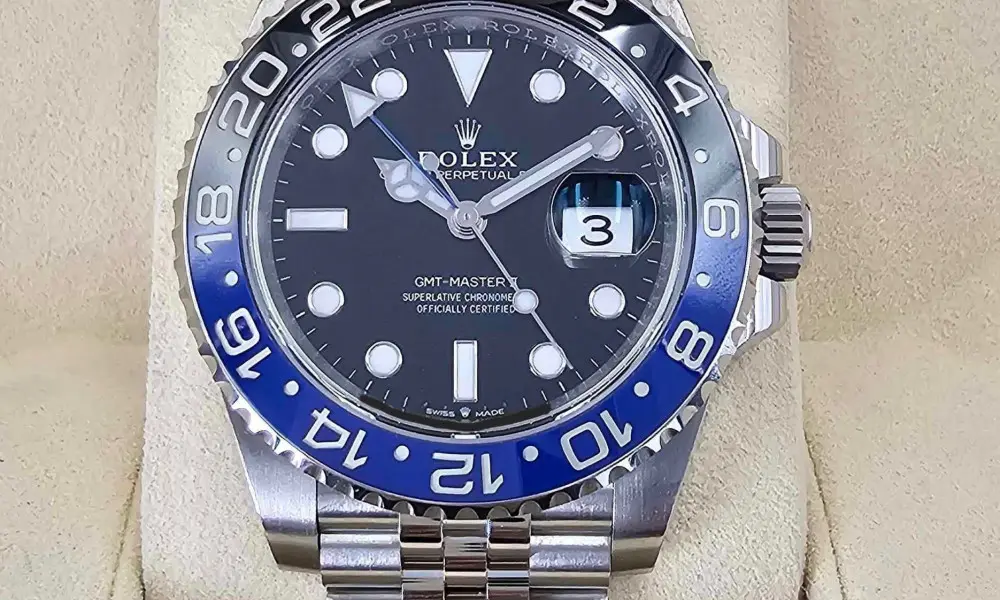

Features of the Rolex GMT Master II "Batman"

Designed for modern adventurers, the GMT-Master II "Batman" embodies limitless travel with its dual time zone display and iconic bezel.

Main features:

- Material: 40 mm Oystersteel case with a black and blue two-tone bezel nicknamed "Batman".

- Movement: Caliber 3285, automatic mechanical, with a power reserve of 70 hours.

- Features: GMT complication allowing the simultaneous display of two time zones thanks to the bi-directional 24-hour graduated bezel.

- Bracelet: Jubilee.

Feature: Highly sought after for its unique design and GMT functionality, with often long waiting times to acquire a new one.

The course of the operation

- Caption presented the offer on its site with a brief summary of the key elements: the partner, the financing objective, the duration of bond holding, the targeted net IRR, and the minimum investment amount.

- Several weeks later, Caption provided access to the information documents to registered users. These documents included: the presentation brochure, the President's decision regarding the issuance of Simple Bonds, the purchase agreement signed by Watch Club, Atelier SC, and Toutim Invest, and the issuance contract for the Simple Bonds.

- In the wake of this, Caption launched the fundraising period. It was at that moment that I subscribed to the offer by making a transfer of €2,160.

- Once the €145,000 was raised, Watch Club (the holding company of Caption) acquired the lot of watches.

- Watch Club has entrusted the conservation and search for buyers (consignment contract) to Atelier SC.

- Seven months later, I received an initial transfer of €1,330.35. Less than two months later, a second payment of €740.77 arrived. Finally, a third and final transfer of €370.88 was made one month later. In total, I recovered €2,442, generating a net profit of €282, which represents a return of +13.06%, fees included.

This profit was then declared for tax purposes as a security. After applying the Flat Tax (30%), it amounts to €84.60

Result of the operation

Final result for this operation which lasted 10 months, €197.40 in net profit after expenses and taxes.

In hindsight, I think I should have invested 10 times that amount. But, as often happens, it's easier to think that way once everything has gone well. Despite a thorough analysis of the platform and its founders, this operation was my first experience with private placement on Caption. Out of caution, I preferred to limit my exposure to reduce risks.

Since then, no other similar offer has mentioned a buyback clause with a premium. Furthermore, the minimum investment on Caption has been raised to €10,000, making these opportunities less accessible than before.

The setup used

One of the main added values of Caption lies in their ability to transform a physical asset into an accessible financial asset. Without this mechanism, it would be impossible to invest just €2,000 in a watch of this range. It would be even more complicated to diversify your investments as here, by simultaneously investing in a lot of seven different watches. Thanks to this system, you reduce your risk while delegating the management, acquisition, storage, and sale to a specialized and experienced company.

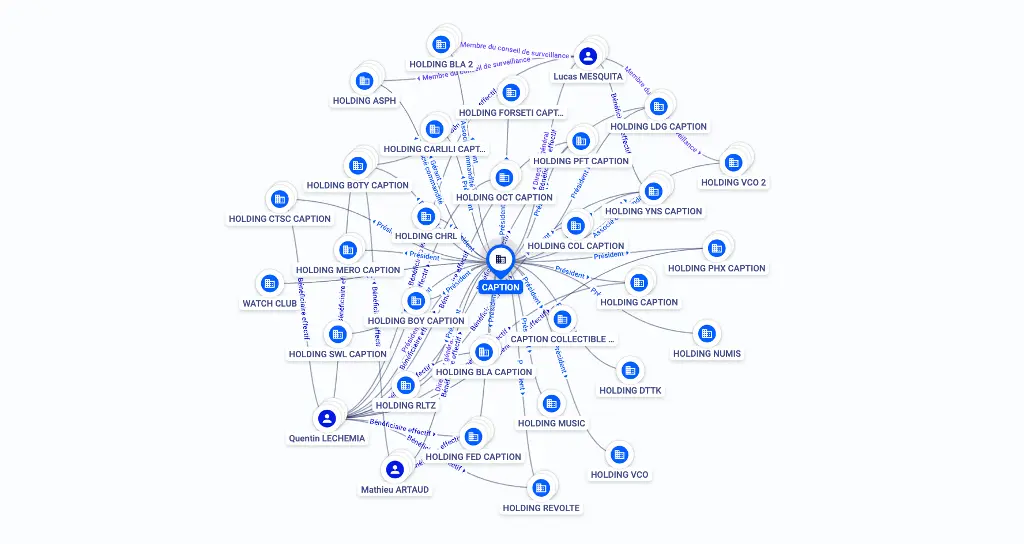

To get to this point, Caption created a holding company specifically for this offer. It uses the same method for each of its investment proposals. Thanks to this mechanism, it was able to acquire, in the name of the holding company, a lot of watches valued at €145,000 and allow interested investors to participate in this lot by issuing 145,000. bonds at €1 each. By investing, you thus become a bondholder of a dedicated holding company, whose sole mission is the acquisition of collectible items. This investment is classified as "indirect." Therefore, you do not have any direct ownership rights over the acquired Rolex watches.

Fees and taxation

Fees

The fees related to this operation represent 8% including tax of the purchase price of the watches. These fees cover annual expenses as well as the costs incurred by the company responsible for conservation, storage, insurance, and the necessary logistical operations. The purchase price of the lot of Rolex watches also includes various fees related to their acquisition and valuation, such as:

- Commissions from auction houses.

- Transportation costs.

- Condition and expertise report fees.

- Import, restoration, and upgrading costs.

- Insurance.

- Hedging against currency risk (for purchases outside the euro zone).

- Structuring and advisory fees.

If the resale performance exceeds the targeted return, a carried interest (share of the net capital gain) may be received by the expert, representing between 10% and 20% of the net capital gain realized. In return, the expert commits to the private placement by subscribing between 5% and 10% of the total amount of the issuance.

Off Market Note

I find it important that our intermediaries are engaged with us in the operations. This encourages them to fully invest in the success of the operation. In this case, they even have a dual interest in maximizing the profit due to the performance commission and the fact that they are also, like us, a client-investor.

Taxation

The income received, namely the 15% reimbursement premium, is subject to the tax regime for securities. For individuals who are tax residents in France, this income is taxed at the flat tax rate (PFU) of 30%, which consists of:

- 12.8% for income tax,

- 17.2% for social contributions.

For legal entities, this income is subject to corporation tax (IS). Please note that an investment via a PEA (Plan d’Épargne en Actions) was not eligible for this operation.

Conclusion

In life, as in investing, true good deals often rely on a subtle balance between continuous monitoring, knowledge, luck, and responsiveness.

Unfortunately, these opportunities are much rarer than one might think, which requires us to be extra vigilant in the face of overly attractive offers. If I decided to participate in this operation, it is primarily because I have great confidence in Caption and I took the time to analyze in detail what was being offered.

For now, no nice watch on my wrist yet, but a new great investment experience that has taught us a lot of things.

My complete analysis of Caption