With its "Income-Generating Assets," Konvi takes another step toward the democratization of investments in alternative assets. A few weeks after launching a liquidity system that allows users to sell their shares, the platform strikes even harder by making its assets generate passive income.

Generate passive income through collectibles

Until now, investing €250 in a tangible asset through Konvi (artwork, bottle of wine, fossil, meteorite, rare and collectible items, etc.) meant patiently waiting for its value to increase and for it to be resold at the end of the defined appreciation period. A long-term model that ties up the entire cash investment for years.

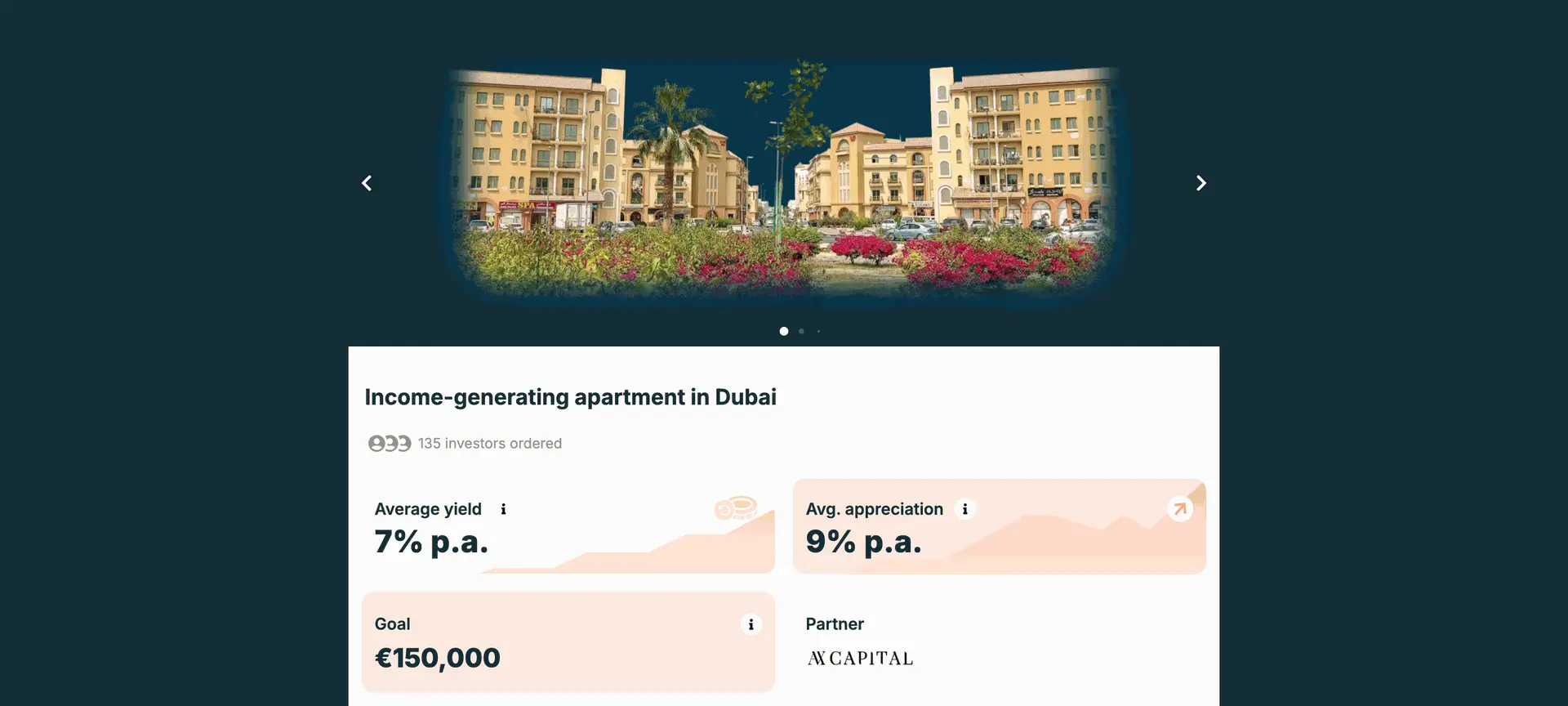

With this new system, the platform is changing the rules: certain assets will now generate recurring income from the moment of acquisition, similar to a rental investment. Moreover, the first offer of this type was published right after the webinar and is an apartment in Dubai International City, with rents being paid monthly to co-investors. The offer was fully funded in just a few hours.

Off Market Note: This solution does not seem the most innovative to us in real estate. There are already many financial tools, such as SCPI or REITs, that effectively meet the need for exposure to real estate in a dematerialized form. We are waiting for Konvi to demonstrate their ability to replicate this system in other categories of niche tangible investments.

From collectible assets to passive investments

At Off Market, we have been asking the question for years: why don't these platforms make assets work during their holding period? A watch can very well be rented for several months, or even years, to a wealthy client. Works of art could be rented to companies to display in their offices. Fossils can be made available to a museum or turned into a paid exhibition, etc.

The answer undoubtedly lies in the logistical complexity, insurance, and risk management. This is precisely the challenge that Konvi seems ready to take on: transforming a fixed asset into a source of income, just as real estate can generate income through rents or a stock can provide dividends.

Konvi accelerates the transformation of exotic investments

By combining passive income and asset appreciation, Konvi adds further advantages to collectible assets. This reduces the risk of loss for the investor while enhancing the appeal of these investments compared to traditional asset classes.

Profitability is no longer just hoped for in the long term; it feeds the investor's appetite throughout the holding and appreciation period.

The company plans to extend this model to other assets: watches, works of art, and even Hermès bags. A physical gallery is currently being created in London, with ticket revenue redistributed to investors.

The Off Market Opinion

After announcing the launch of a project aimed at making all its classes of tangible assets as liquid as stocks, through a secondary marketplace called "Exotic Vaults" expected in September, Konvi continues to tackle other barriers that hinder investment in collectibles.

The company is leading the way for all players in the sector. It skillfully blurs the line between pleasure assets and wealth assets. This full-scale crash test will force other platforms to consider similar solutions to remain competitive and stay in the race.

The promise is ambitious. All that’s left is to keep it.